Demystifying the Profit & Loss Statement

Still Confusing. Only less confusing

The Profit and Loss Statement is one of the integral financial statements that you need to understand the financial health of your business.

There are many reasons you need to have a P&L, such as getting a loan.

But more importantly, a P&L is essential for determining your business’s tax liability. And most importantly, it is a key document for helping you determine important business decisions.

It goes by many names — P&L, income statement, statement of profit and loss, statement of operations, financial expense statement, income, and expense statement. But no matter what you call it, they are all measuring the same thing.

I’m going to do my best to help make it all make sense in this post today.

TL;DR

The primary purpose of a P&L for small business owners is to determine if the company is profitable.

Accountants may use the P&L statement to help gauge the accuracy of financial transactions.

Investors will use the P&L to gauge the health of a company.

Accountants and investors alike use the P&L to summarize the revenue, costs, and expenses incurred during a specific period of time, though typically you’ll see it for a fiscal quarter or year.

Simply put, the P&L takes revenue (AKA top line) and subtracts the cost of doing business, cost of goods sold (COGS), operating expenses, tax expense, interest expense and other expenses.

What’s left is the profit (AKA bottom line or net income).

From there, you can use different ratios to help give you an inside look at your company’s ability to generate a profit by increasing revenue, reducing costs, or sometimes both.

First thing’s first – what’s in a P&L?

You’ll generally have four categories that can then be broken down into further subcategories:

1) Revenue – Income from your sales and other payments made to your business

2) Cost of Goods Sold (COGS) – your direct costs

3) Indirect Expenses – your overhead

4) Net Profit – Everything that’s left. Revenue – (COGS + Indirect Expenses) = Net Profit

Revenue

You know what revenue is. I hope, at least.

It’s all the sales that you make combined with other payments made to your business within the given time period.

The other payments could include selling property or old equipment or any other one-time revenue-generating events.

Usually, this is detailed in a separate table and the sum total is imported into the P&L statement.

Cost of Goods Sold (COGS)

This refers to costs that can be exclusively attributed to the production or sale of a product or service.

COGS includes the costs of materials used and any labor directly involved in the product or service.

These costs exclude all other labor and indirect expenses, such as marketing, accounting, training, rent, insurance and all other labor.

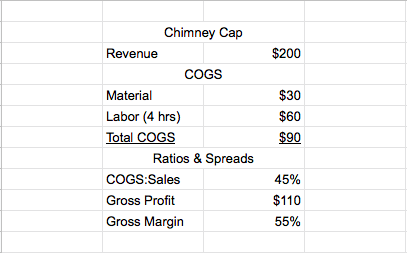

For example, let’s say that we charge $200 to replace and repair a chimney cap at Patriot Chimney.

Then say our materials cost us $30 and we hire two guys to help at $15 per hour and the job takes 2 hours to complete.

Our materials cost ($30) plus direct labor cost (2 workers * $15/hr * 2 hours = $60) equals $90 in COGS.

At this point, there are three really important numbers that we can evaluate: The COGS-to-Sales ratio, Gross Profit, & Gross Margin.

COGS-to-Sales Ratio

This is simply seeing what percentage of sales revenue is used to pay for expenses.

Truthfully, this ratio is how COGS is generally expressed.

By generating this ratio, you can see how efficient or productive your sales operation is.

As a general rule, your combined COGS and labor costs should not exceed 65% of your revenue, though it certainly varies depending on your region and market.

Comparing your COGS to other businesses will allow you to see a couple things.

Maybe you need to lower your costs or increase your prices.

Knowing this is a great first step to understanding your financial health.

Gross Profit & Gross Margin

The gross profit formula is: Revenue – COGS = Gross Profit.

Gross profit is typically depicted as a nominal amount and gross margin is usually depicted as a percentage.

The gross margin formula is: (Gross Profit / Revenue) X 100 = Gross Margin Percentagge

The gross margin is a key indicator and the higher the percentage the better.

This number can also convey how competitive your business is and can be in the future.

Look at this example from the chimney cap scenario I mentioned above:

Other Considerations

It’s important to keep track of all expenses so you know the company’s gross revenue vs. net revenues.

But there are many other factors to keep track of COGS.

The most important being for taxes (yuck!)

COGS are business expenses. So that means they don’t count towards gross revenue.

And COGS are an expense line item in your company’s P&L.

Your company will only pay taxes on net income (more below).

But keep in mind that while a high COGS means lower taxes, it also means lower revenue for the company. So it’s important to manage your COGS efficiently to increase your profits.

Indirect Expenses

“Indirect expenses” is an accounting term for overhead, which is also just a term that means “what it costs to run your business.”

This is the money spent on general maintenance of your business and includes things like:

- Employee salaries (tricky, though)

- Travel & training

- Consulting

- Marketing

- Telephone & Internet

- Insurance

- Rent

- and way more than I should list

Your indirect expenses should be compared to your revenue so that you can see how you’re doing.

This will help give you a starting point when making predictions about expanding or contracting your business.

For example, let’s say that your business made $100,000 in revenue this quarter and you spent $35,000 on indirect expenses. This means that your indirect expenses are 35% of your gross revenue.

Profit or loss: Net Income, Operating Income, EBIT

Just like with the P&L Statement as a whole, the bottom line is called plenty of things: net income, operating income, EBIT.

But, once again, it doesn’t matter what you call it, it’s all the same. And you can measure so many different things with it.

At this point, you should be able to calculate the net income, simply by subtracting your indirect expenses from your gross profit.

Also known as your bottom line, this will hopefully result in a positive number, reflecting a profit for the time period.

If it’s negative, then that means you have a loss and some work to do in decreasing your operating expenses.

You can also take the COGS and add it to your Indirect Expenses to give you your Operating Expenses (or OPEX).

Ideally, your OPEX will be less than 65%. And that number depends entirely on the size of your business, how many employees you need, and several other factors.

Figuring out a way to decrease your OPEX can increase your company’s earnings, which can make your business very attractive to investors.

However, it could hurt your company’s profitability if you’re not careful.

For example, if you cut the wrong expenses it could affect your productivity and therefore your profitability.

Net Profit

Net profit is the ratio of after-tax profits compared to net sales. This shows how much profit you have after all OPEX are deducted from revenue. This means that net profit is one of the best measures of the overall financial health of a company.

The formula is simple: (Net Profit/Net Sales) x 100

While it’s extremely important, it does have it’s limits.

For example it really is a short-term measure and doesn’t reaveal much about a company’s action to maintain profitability over the longterm.

This is why it’s typically viewed in a trend line to see how a company has done over a period of time, hopefully trending up.

Another issue with it, especially when comparing your net profit with other businesses, is the fact that it can be artificially driven down when the company’s owner wants to minimize income taxes.

They do this by increasing the number of taxable expenses into the reporting period. This practice is most commonly found in privately held businesses, where there is no need to impress outside investors.

What to Watch Out For & Other Considerations

Of course the first thing you should do when measuring your P&L is keep track of how your business has performed over the years and compare year over year or quarterly to understand how you trend.

Some common things that you can evaluate are:

Increasing Sales & Declining Profits – There are a lot of things that can be wrong. This typically indicates a disconnect somewhere in your business and you need to figure out what it is and how to fix it. Maybe your prices are too high or you grew too quickly.

Stagnant Sales – Maybe you need to expand into a new market or spice things up with marketing. You may need to diversify your business more to protect you from stagnant turning into declining.

Creeping Overhead – you should keep up with all of your overhead. This could lead to you needing to switch providers or changing locations to get cheaper rent. See what you can do to lower costs without sacrificing revenue.

Increased COGS – Maybe this is an industry-wide issue or just your suppliers. Maybe it’s more of a temporary macro-economic issue rather than something that will affect your business for a longer period.

You should keep tabs of how your business has done historically along with how you do compare to the market and industry. You can create benchmarks to aim for and compare month to month, quarter to quarter, and year to year.

Here are a couple of other tips to help make your P&L a little nicer:

Review Pricing Opportunities – At Patriot Chimney, we aren’t 100% sure if the reason we aren’t winning larger jobs is because of our pricing.

In order to test this, we have created a new project to create a more thoughtful pricing strategy.

The goal of doing this is to create a price that is more in line with the supply and demand equilibrium than we currently have.

Hopefully, what this will do is increase our revenue, while keeping all of our costs the same and therefore increasing our bottom line.

Use zero-based budgeting – the purpose of this is to require all expenses to be justified for each new period, thus starting from a zero base. This will require you and your team to analyze each expense for its need and costs.

Compensate for productivity rather than time – We do this at Patriot Chimney for our management and support staff.

Also, any work that I outsource is typically set on a fixed budget that way I know exactly how much it’s going to cost and hopefully will encourage our staff to work in the most efficient manner possible.

Outsource when advantageous – When I don’t know how to do something that needs to be done to help our business there are two things I can do:

- Learn it or

- Hire someone.

The decision comes down to how fast I need it, how well can I do and will I need the skill ever again.

Sometimes it’s more cost-effective in the long run if I just learn how to do it or we train someone on staff to do it, while other times it makes more sense to find someone who specializes in the task.

Conclusion

I hope I helped remove some of the complications that come with accounting and the P&L statement and I hope that you can take this information to help grow your business.

Share on LinkedIn, Facebook or Twitter so your colleagues can learn some too. Leave a comment about how you plan to utilize this new information in your business.